Business

Safaricom Raises Fuliza Overdraft Limits Within Hours of Airtel Announcing New Mobile Money Credit Service

Safaricom PLC has moved swiftly to increase overdraft limits for its Fuliza service users, in what market observers describe as a direct competitive response to Airtel Kenya’s recent introduction of a similar mobile money credit facility.

The adjustment to Fuliza credit limits became apparent within hours of Airtel’s announcement of its new overdraft product, signaling heightened competition in Kenya’s mobile financial services sector as telecommunications companies vie to retain and attract customers seeking convenient access to short-term credit.

Customer Reports Confirm Limit Increases

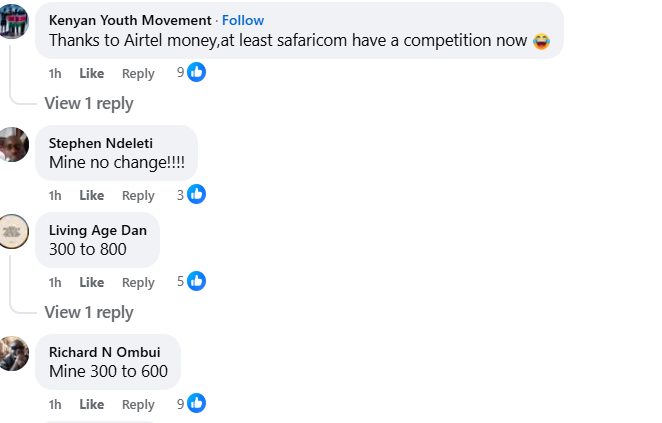

Multiple M-Pesa users reported receiving notifications of enhanced Fuliza limits on their mobile money accounts, with screenshots circulating on social media platforms confirming the increases. The adjustments appear to vary by customer, likely reflecting Safaricom’s risk assessment algorithms that consider individual transaction histories, repayment behavior, and account activity patterns.

Safaricom has not issued an official statement specifying the exact criteria for limit increases or the range of new borrowing capacities being offered to different customer segments. However, user reports suggest that long-standing customers with consistent repayment records have received the most substantial limit enhancements.

Strategic Response to Market Competition

The timing of Safaricom’s action strongly suggests a strategic response to competitive pressure from Airtel Kenya, which recently unveiled its own mobile money overdraft facility designed to allow customers to complete transactions even when their account balances are insufficient.

Airtel’s entry into the mobile credit overdraft market represents a significant challenge to Safaricom’s dominance in mobile financial services, particularly given that Fuliza has become one of M-Pesa’s most utilized features since its launch. Industry analysts note that overdraft services generate substantial revenue through interest charges and service fees while simultaneously increasing customer loyalty by providing convenient financial flexibility.

By raising Fuliza limits promptly, Safaricom appears to be working to retain existing customers who might otherwise be tempted to migrate toward Airtel’s competing service or to maintain accounts with both providers.

The Fuliza Service Model

Fuliza, launched in partnership with Commercial Bank of Africa (now NCBA Bank) and Kenya Commercial Bank, allows M-Pesa users to complete transactions when their wallet balances are insufficient by automatically extending short-term credit. The service charges daily facility fees along with access fees calculated as a percentage of the borrowed amount.

Since its introduction, Fuliza has become deeply integrated into the daily financial lives of millions of Kenyans, facilitating everything from bill payments to merchant transactions when cash flow timing creates temporary shortfalls. The service’s popularity stems from its instant approval process, elimination of traditional loan application procedures, and seamless integration with M-Pesa’s existing functionality.

Mobile Money Market Dynamics

Kenya’s mobile money ecosystem has evolved into one of the most sophisticated in the world, with M-Pesa serving as the dominant platform. Safaricom’s service processes billions of shillings in transactions daily, touching nearly every sector of the Kenyan economy from retail commerce to utility payments and person-to-person transfers.

However, Airtel Money has been steadily expanding its market presence, capitalizing on competitive pricing strategies, aggressive customer acquisition campaigns, and feature innovations designed to challenge M-Pesa’s market leadership. The introduction of an overdraft facility represents Airtel’s latest attempt to offer comparable functionality to Safaricom’s established services.

The intensifying competition benefits consumers by driving service improvements, better pricing structures, and increased credit access options. However, it also raises questions about responsible lending practices and the potential for customers to accumulate unsustainable short-term debt across multiple platforms.

Financial Inclusion Implications

Mobile money overdraft services like Fuliza represent a significant development in financial inclusion, providing access to instant credit for millions of Kenyans who might not qualify for traditional bank loans or credit cards. For many users, these services serve as emergency financial buffers during unexpected expenses or temporary cash flow difficulties.

Critics, however, have raised concerns about the ease of access to credit potentially encouraging unsustainable borrowing patterns, particularly given the relatively high interest rates and fees associated with such services compared to traditional banking products. The daily compounding nature of charges can result in significant costs for users who maintain outstanding balances over extended periods.

Financial literacy advocates emphasize the importance of users understanding the full cost structure of mobile money credit services and using them judiciously for genuine short-term needs rather than as long-term financing solutions.

Regulatory Oversight

The Central Bank of Kenya maintains oversight of mobile money services, including credit facilities offered through telecommunications platforms. Regulators balance encouraging financial innovation and inclusion against ensuring consumer protection and maintaining financial system stability.

As competition intensifies in the mobile credit space, regulatory authorities may need to consider whether additional consumer protection measures are warranted, particularly regarding transparency in fee structures, responsible lending assessments, and credit reporting practices.

Market Outlook

The rapid response by Safaricom to Airtel’s competitive move suggests that Kenya’s mobile financial services market is entering a more dynamic competitive phase. Customers can likely expect continued service enhancements, promotional offerings, and feature innovations as telecommunications companies compete for market share in the lucrative mobile money sector.

For Safaricom, maintaining M-Pesa’s dominant position requires continuous adaptation to competitive threats while preserving the service quality and reliability that have made it indispensable to millions of Kenyan users. The Fuliza limit increases represent one tactical response in what appears to be an evolving competitive landscape.

As both providers expand their credit offerings, the ultimate beneficiaries should be Kenyan consumers who gain access to more options, potentially better terms, and improved service features driven by market competition. However, users are advised to carefully compare the terms, costs, and conditions of competing services to make informed decisions aligned with their financial circumstances and needs.

The telecommunications companies have not provided official comments on the competitive dynamics or future plans for their respective mobile money credit services.

-

Education1 week ago

Education1 week agoUniversity of Nairobi Opens 50+ Courses for KCSE C Plain Students in 2026

-

Gossip3 days ago

Gossip3 days agoMarion Naipei Speaks Out: “Those Videos Are From 3 Years Ago, I’m Born Again Now”

-

Education1 week ago

Education1 week agoMount Kenya University Opens Educational Pathways for C Minus KCSE Graduates: 2026 Admission Guide

-

Education1 week ago

Education1 week agoCourses You Can Study at Maseno University With a C Plain Grade

-

Education1 week ago

Education1 week agoKUCCPS Sets Date for Opening of University and College Placement Portal

-

Education1 week ago

Education1 week agoEducational Opportunities at Egerton University for C Plain KCSE Graduates

-

Education6 days ago

Education6 days agoComprehensive Guide to Approved Universities in Kenya and Fee Structures for 2026: What Students Need to Know

-

News17 hours ago

News17 hours agoKenya Introduces Green Number Plates for Electric Vehicles to Combat Carbon Emissions